A Cyclical Lens on the Digital Revolution.

In the digital arena spanning iGaming, crypto casinos, stablecoins, and meme tokens market dynamics often echo classic cycles of boom and bust. Surprisingly, a 19th-century theory by Samuel Benner provides a compelling framework for understanding how emotion-driven markets move and what’s to come. As thought leaders in digital marketing, iGaming, and crypto strategy, we’re uniquely placed to explore how the Benner cycle originally devised to interpret agricultural commodity prices can anticipate the trajectory of modern tokenised ecosystems and casino innovations.

1. Samuel Benner’s Cycle Unpacked

1.1 Origins and Structure

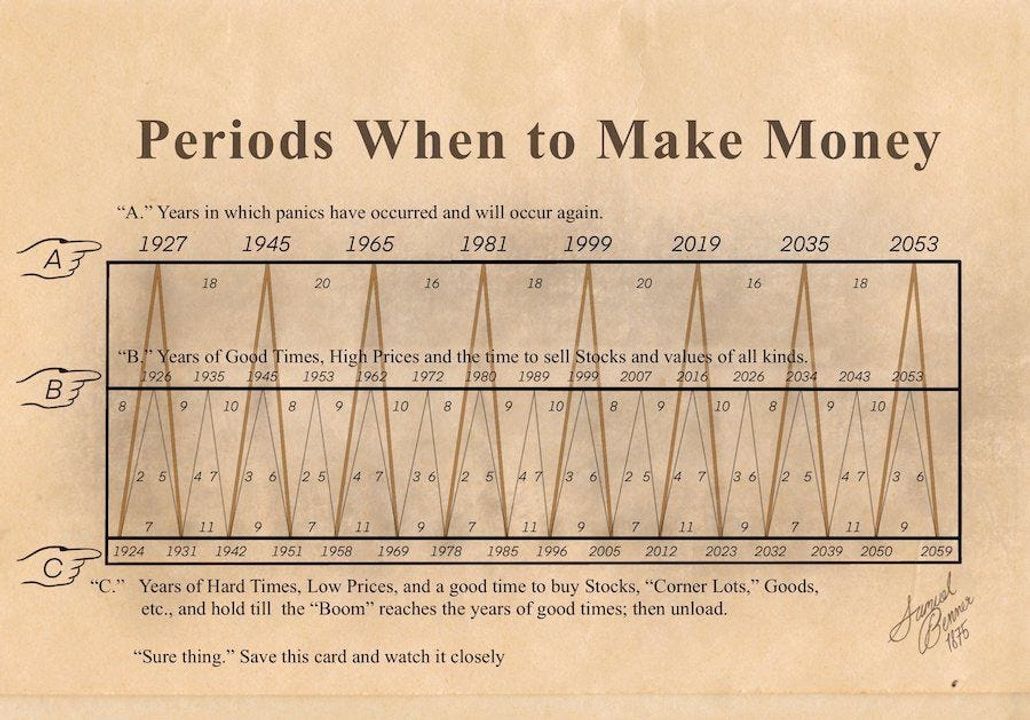

Samuel Benner, a farmer-turned-analyst, developed his making-money cycle in the aftermath of the 1873 financial crash. In 1875 he published Benner’s Prophecies of Future Ups and Downs in Prices, mapping cycles of panic years (A), good times (B), and hard times (C). These were rooted in observations of agricultural commodities corn, pig iron, cotton linked to natural cycles like solar activity.

1.2 Patterns and Predictions

Benner discerned 11-year corn and pig cycles, with intermediate 5–6 year peaks. He identified a 27-year pig iron cycle, with troughs at 11, 9, or 7 years and peaks roughly every 8–10 years. He labelled years of panic (A), boom (B), and stagnation (C), marking a recurring rhythm through decades.

1.3 Historical Alignments

His projections famously align with major downturns like the Great Depression in 1929, World War II economic shifts, the dot-com bubble, and the COVID-19 crash. Analysts note that, while not numerically precise, the model often captures sentiment cycles panic, good times, hard times resonating with human psychology.

1.4 Modern Relevance

Articles today suggest the Benner cycle predicts 2023 as an ideal accumulation year, followed by a 2025–2026 peak (“good times”) before a downturn through 2032. Analysts in the crypto community echo this framework citing 2026 as the next peak.

1.5 Skepticism & Criticism

Critics caution that Benner’s model lacks scientific rigour and may overfit selecting past events to support a narrative. Some traders consider it more distracting than reliable. Reddit users note the risk of overconfidence in rigid historic patterns in fast-evolving markets.

2. The iGaming & Crypto Casino Landscape Today

2.1 The Digital Betting Ecosystem

The online gambling universe has evolved from pop-up poker rooms to globally regulated platforms offering sports betting, poker, bingo, and crash games with crypto-powered variants gaining traction. Crash games originated with Bitcoin-based platforms like Bustabit around 2014 and evolved into mainstream features like Aviator, merging chance, timing, and algorithmic fairness.

2.2 Crypto’s Role

Crypto casinos leverage blockchain’s transparency, pseudonymity, and innovation. Stablecoins such as USDT and USDC mitigate volatility, offering a bridge between fiat-centric regulation and token-based flexibility.

2.3 Meme Tokens & Utility Coins

Meme tokens jokey, hype-driven assets find pathways into iGaming via loyalty programmes, staking incentives, and gamified reward mechanisms. Such tokens thrive in speculative upcycles, amplifying engagement.

2.4 Stablecoins as Transaction Fabric

Stablecoins are becoming essential for seamless, scalable user experiences in crypto casinos. Their predictable value supports wagering, payouts, and liquidity management crucial in volatile markets.

3. Aligning Benner’s Cycle with Digital Gaming Innovation

3.1 Phase-by-Phase Analysis

Let’s align Benner’s phases with the evolving iGaming space:

- Panic Years (A) Historically crisis-driven, for example 2008 or 2020. In crypto, 2022’s “crypto winter” reflects this phase, with sharp declines and consolidation.

- Good Times (B) Boom periods when technology and optimism converge. The 2020–2021 NFT and DeFi explosion exemplifies this.

- Hard Times (C) Less speculative, more structural growth and accumulation, for example 2015–2017 stabilisation.

Currently, we may be in a late C into early B phase positioning for the upcoming peak around 2025–2026.

3.2 Stablecoins: The Rising Tide

As crypto markets mature within the cycle, stablecoins offer grounded reliability especially significant in “good times” when volume surges and volatility spikes.

3.3 Meme Tokens & Hype Dynamics

Boom cycles catalyse frenzied speculation. Meme tokens tied to iGaming platforms are likely to proliferate, offering staking, cashback, and gamified hooks to capture both players and retail interest alike.

3.4 Regulation, Consolidation & Survivorship

Booms attract entrants many overextend. Post-2026, tighter regulation and market consolidation will elevate only disciplined, compliant operators.

3.5 Strategic Timing for Operators & Affiliates

- 2024–2025: Build infrastructure, integrate stablecoins, prototype token systems.

- 2026: Monetise the boom aggressive affiliate acquisition, token launches, promotional hype.

- 2027 onward: Defend diversify, retain liquidity, pivot creatively in downturn.

4. Thought Leadership Perspective: Strategy Under Benner’s Lens

4.1 Optimal Investment Timing

- Pre-2026: Seed marketing campaigns, partnerships, and innovation pilots.

- 2026 Boom: Maximise visibility token drops, NFT reward systems, stablecoin integration.

- Post-boom: Deepen customer loyalty, diversify into new verticals such as esports or VR gaming, and refine operational resilience.

4.2 Content & SEO Opportunity

Pitch timely content ideas such as:

- “Why 2026 Will Be the Golden Year for Crypto Casinos”

- “Stablecoins: The Backbone of the Next iGaming Boom”

- “How Meme Tokens Will Reshape Player Engagement in iGaming”

Optimise with LSI keywords like crypto casinos, stablecoin gaming, meme tokens in iGaming, iGaming trends 2025, and Benner cycle forecast.

4.3 Risk & Governance

Despite potential profits, the post-2026 downturn could be disruptive market cap contractions, liquidity freezes, or regulatory clampdowns. Forward-thinking brands will balance aggression in booms with sustainability and compliance.

5. Broader Implications & Final Insights

5.1 The Psychology of Cycles

Benner’s enduring appeal lies not in predictive precision but in his mirror to human emotions fear, euphoria, despair. Markets, especially speculative ones, often reflect these emotional arcs.

5.2 Not a Crystal Ball, but a Compass

As critics rightly assert, Benner’s model shouldn’t dictate decisions in isolation but it can serve as a valuable macro framework.

5.3 The Digital Fuel Advantage

Our strength lies in anticipating phases: build quietly, boom creatively, consolidate strategically. Aligning marketing, tech innovation, and token economics with cyclical rhythm yields an edge.

Conclusion: A New Digital Boom Beckons

Samuel Benner’s 150-year-old cycle intriguingly aligns with what we see and anticipate in iGaming, crypto casinos, stablecoins, and meme-token ecosystems. If current patterns hold, 2025–2026 may mark the launchpad of a spectacular digital boom.

For operators, affiliates, and marketers within the iGaming and crypto spaces, now is the moment to build, innovate, and deftly position for the cycle’s crescendo. When the hype arrives, let’s be ready to ride it and sustain the momentum after the wave recedes.

I know this article is a bit left feild but I wanted to highlight the cycles and what may happen next. If you would like to know more on how we view the next 5 to 10 years in Igaming then please get in touch.